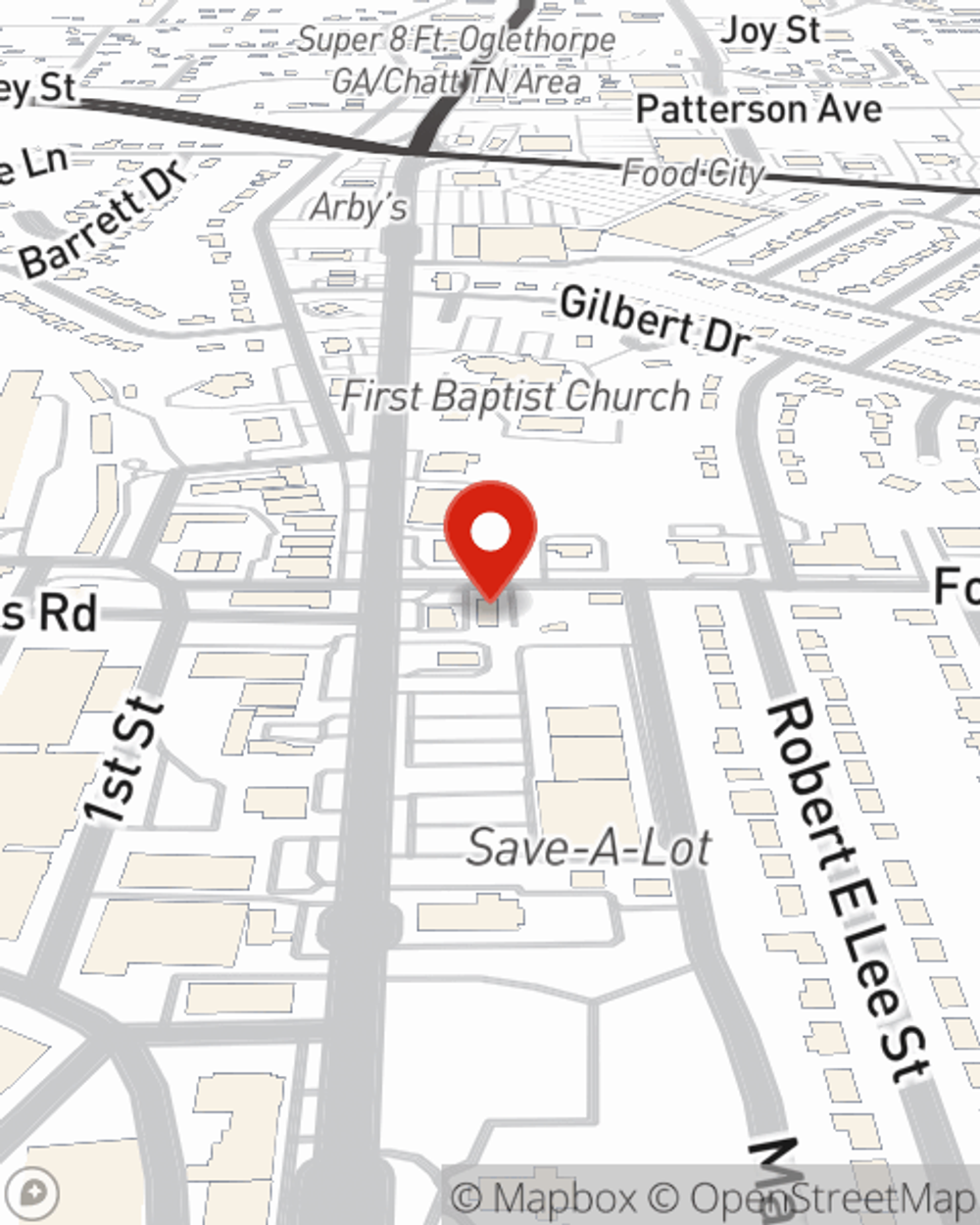

Life Insurance in and around Ft Oglethorpe

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

- Catoosa County

- Hamilton County

- Walker County

- Dade County

- Chattanooga

- Ringgold

- Lookout Mountain

- Rock Spring

- Signal Mountain

- Chickamauga

- Fort Oglethorpe

- Rossville

- Bradley County

- Rising Fawn

- Dalton

It's Time To Think Life Insurance

If you are young and just starting out in life, it's the perfect time to talk with State Farm Agent Erin Crane about life insurance. That's because once you have a family, you'll want to be ready if tragedy strikes.

Coverage for your loved ones' sake

Now is a good time to think about Life insurance

Love Well With Life Insurance

One of the ideal times to get Life insurance can be when you're just starting out. Whether you decide to go with level or flexible payments with coverage to last a lifetime coverage for a specific number of years or another coverage option, State Farm agent Erin Crane can help you with a policy that can help cover your loved ones.

As a commited provider of life insurance in Ft Oglethorpe, GA, State Farm is ready to protect those you love most. Call State Farm agent Erin Crane today for a free quote on a life insurance policy.

Have More Questions About Life Insurance?

Call Erin at (706) 419-8650 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.

Simple Insights®

What is Return of Premium life insurance?

What is Return of Premium life insurance?

What if a life insurance policy refunded all the premiums you paid if you outlive the term. That's the premise behind Return of Premium life insurance.

When to review your life insurance coverage

When to review your life insurance coverage

If it's been a while since you've done a life insurance policy review, now may be a good time for a life insurance checkup.